Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

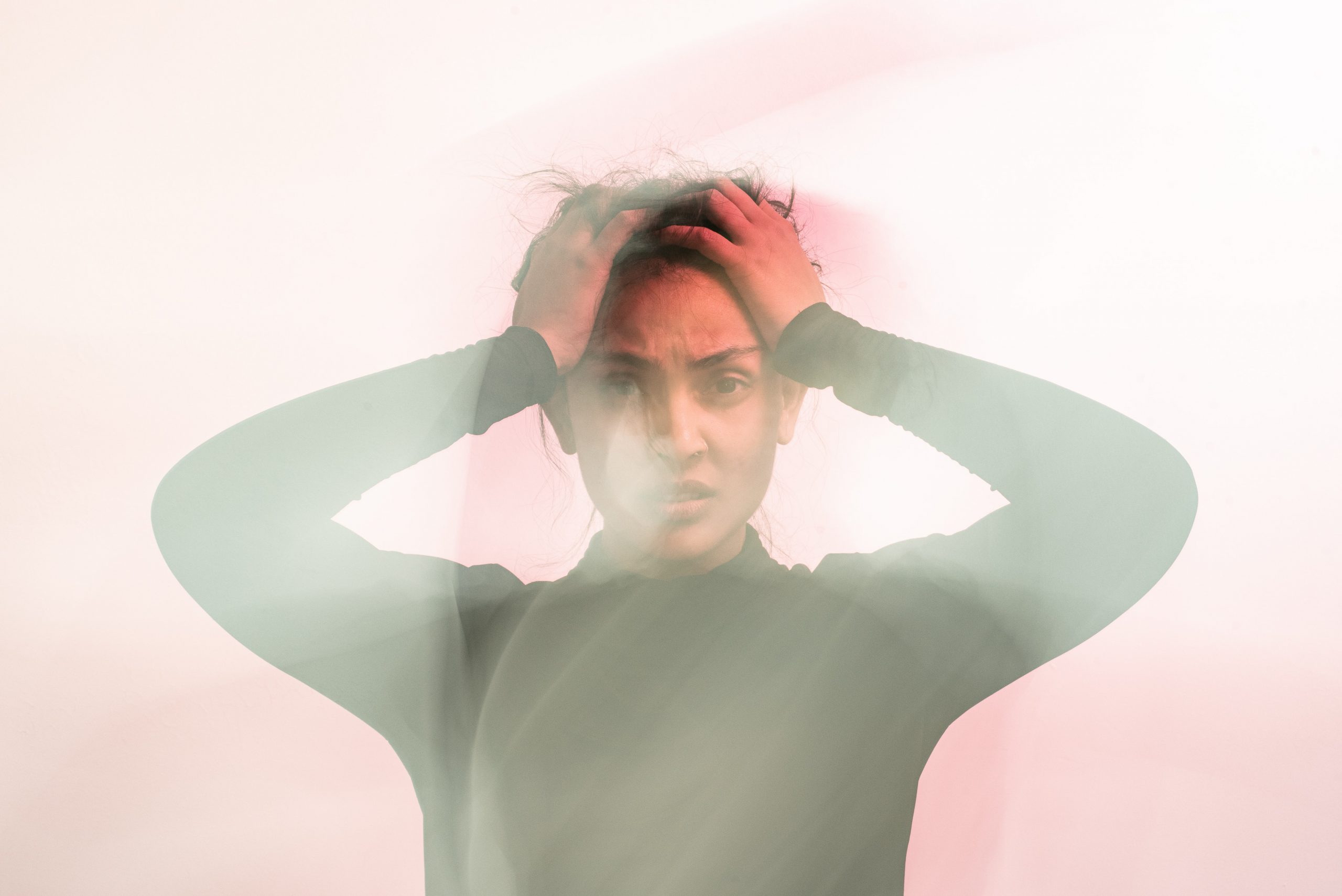

Confusion Is The State of The Market

We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

So, if not last year at this time, then when or what do we compare to? First, I think you have to recognize that 2021 and early 2022 were such abnormal times in our market that they don’t make a great basis for comparison to start with. When a market is accelerating at such a strong rate, any slow down is going to look extreme. When our weekly or monthly inventory levels were so low, comparing available homes to those times makes any “normal” inventory level look out of balance, especially if you use percentages for comparison. I think a better perspective is to look at the general market sense. We have seen price appreciation settle back down to a 4.5% range for annual appreciation over the past 2 years in Seattle and about 7% per year on the Eastside. By any historical standard, this is a very good rate for homeowners and provides sound reasons for home buyers to want to own their home.

We saw interest rates rise from 3% to 7% between March to September. This again was unprecedented. We’re now seeing rates moderate and drop to the 6.125% range, lower if you’re borrowing in the $1M+ range, closer to 5.5%. Rates are likely to see some bumps and gyrations this spring but the expected trend is for modest declines. There are also some reduced fees for some first time borrowers, to help ease the funds needed to secure a loan. The moderations in rates, even though still well above last winter’s rates, is good for home buyers and sellers. Payments and affordability are improving.

My perspective is this: there is always a market. People want to own their own home–it’s a wise investment and a great stabilizing force in controlling our lives. If you have fears of a recession, you have control over your housing costs, likely lower than rental rates. If you have fears of inflation, you again have control over your housing costs and an appreciating asset. If you have the desire to buy or change your home, the market is looking for good homes and there are solutions to help you afford your new home.

Home buyers are not overwhelmed with home choices in almost any area or price range. The headlines of a glut of inventory are nowhere near accurate. Yes, there’s some inventory, but most of us active in the market know we still have a scarcity of good homes to choose from. This is great news for home sellers. We currently have a stalemate in the thinking of some buyers and sellers in the market. The Sellers want last spring’s prices and the Buyers feel that if they hold out on making offers, home sellers will have to lower their prices. Both parties have too biased of perspectives.

Last spring, buyers were paying 20-40+% over asking prices. As I stated before, we’ve seen those sale prices decline by 15-30% depending on location and price range of the home. Today’s home sellers are generally accepting offers 2-3% under their asking prices. Buyers may be hoping to get 20-40% below asking prices but that’s not realistic and it won’t be going forward, either. Some home sellers still want last year’s values but that too isn’t going to happen. Instead, look at 5-7+% gains of the last few years and accept that’s very strong for annual real estate appreciation. Since most home sellers have owned their homes for 5+ years, your effective gain in value is still phenomenal. Recognize that buyers are still paying a higher price, in terms of monthly payments, than they were last year, so accept your good fortune for the value of your home and sell it, if that is your need, desire or intention.

Many people are fearing a recession this year and we’re now hearing more local employers will be laying off employees versus the hiring freezes we saw last year. Some may feel like they shouldn’t be risking a home purchase during these uncertain times. That’s a very wise consideration. It is never wise to buy a home if you think you will need to sell it in less than 3-5 years. Patience, not fear, can be your friend. I would still offer some perspective to also consider. We’re at near record low unemployment levels. If you were to lose your current job, how likely is it you would find another one, locally, in the near future? For most of our local employees, the answer is usually very good odds for finding a comparably paying job in a fairly short time frame. Still, no one wants to lose their job, without their control. The solution may well be to sit still and ride out the first half of this year and see how your job and company are performing. Interest rates are expected to soften going into the second half of the year and inventory will likely increase to offer you more good choices. Late summer and fall often present better market conditions for home buyers.

While we’re talking about inventory increases, let’s address another unrealistic hope or fear. Home inventories will continue to balloon, foreclosures will rise, home prices will drop substantially and you’ll be able to get that 20% low offer accepted by any or every home seller. Do you recall me talking about the above normal appreciation our local homeowners have been experiencing? This now equates to the average local homeowner having 40+% equity in their home. If they were in real need of their home’s equity, they would sell it, even at today’s prices or lower—if we follow the pessimist’s logic, but certainly not lose it to foreclosure. Additionally, we had 70+% of homeowners, with a mortgage, refinance their home between 2020 and the early spring of 2022. These folks aren’t likely planning to sell their home any time soon. They have as low of a house payment as they can get–lower in most cases than they could rent any type of home for–so they won’t be selling now or in the near future. This will keep overall inventory levels in check. The rationale that panicked home sellers will be flooding the market with inventory isn’t a reality; certainly not in our local market. Pessimistic buyers in this market are looking for “a deal” more than a home. If that’s your perspective, you likely won’t find the deal you want and you’ll miss good opportunities to own a home and asset that will perform very well for you. But they, hopefully not you, were only looking for a deal.

The reality is simple and usually constant for real estate. There is always a market. If you have a need or desire to buy or sell, opportunities are and will be available in this market. We have a more balanced market–supply of homes matching demand by buyers–than we’ve had in the past 4-5 years. We have an overall strong local economy with good, stable employment–even with the headline fears–and we have improving interest rates. We still have increasing household formations as our millennial population grows and a pretty steady supply of the baby boomer population retiring and likely ready to capture their equity and change their housing situation. It’s not frenetic, like the last 2 years, but it’s a market that works for buyers and sellers, if you’re realistic and want to be in the market.

Give me a call to discuss your interests, needs and concerns. We can create a strategy to help you win in these confusing times. I’m happy to talk when you are. Thank you for your time.

Post Photos by Uday Mittal on Unsplash and Brett Jordan on Unsplash

Where Is Our For Sale Home Inventory?

Some of us likely remember the Johnny Carson show and his banter with his audience of “how crazy is it….” Well, it’s pretty crazy out there.

Some of us likely remember the Johnny Carson show and his banter with his audience of “how crazy is it….” Well, it’s pretty crazy out there.

Likely many of you also saw the skit on Saturday Night Live a couple of weeks ago spoofing Zillow searches for homes as today’s dating or other unusual website surfing. It’s true, since the Covid crisis, home searching and buying seems to have become “the” national pastime. Many want to get away from or get out of their homes, even if only dreaming, while others truly want to find their new home. While the skit was very funny, finding and buying a home in today’s market is very challenging.

Strong demand for a change in our house style, size, location and features coupled with record low interest rates are creating unprecedented circumstances. The freedom and need to work from home, teach and learn from home, get some separation and privacy–safety and distance are all adding to the demand part of the picture.

At the same time we have unprecedented refinances taking place as interest rates have been in the mid 2% range which is allowing many to refinance their home loans and save $100’s to $1,000’s of dollars on their house payment. Great news for these home owners but it also means these home owners aren’t likely selling their homes for several more years–like 5, 7 or 10+ years to come. This is creating a significant shortage of homes for sale. While this is bad across the country, it’s staggering in our region. One silver lining to this point is these home owners aren’t likely to be competing buyers any time soon either.

So how bad is it?

In all of King County we only have 887 homes on the market for sale as of 2/17/2021; adding condos to the figure adds 796 more choices for a combined total of 1683 homes for sale. Typically this figure would be in the 3-4,000 range for an average month. The current inventory represents only .00185% of all homes in our region being for sale. That’s 1/4 to 1/3 of last years record low levels. Snohomish County is even worse with a combined houses and condos total of only 251 total homes for sale. That’s .0008% of all households in Snohomish County and 10-15% of normal inventory levels. The Eastside area has only 354 combined homes for sale and South Snohomish County only 124 total homes for sale. This is all homes, no bedroom, bathroom, price range or features as filters, just a house or condominium being for sale! Crazy! By the way, the national inventory level is only at 1.2% but that’s still well above our local figures.

Active agents like myself are hopeful for some increase in homes for sale but from these low levels, any increase will be welcome but not likely enough to change the real dynamic of what it’s like to be a home buyer in the present market. I know many people think or thought we would be seeing a collapse in home prices, some form of bubble bursting. We all remember the economic collapse from 2008-2010 and no one wants that repeated. Now let’s look at what an economic recovery will mean for our region, the country and the world as a whole. As more businesses reopen, new jobs will be created and filled; more people with more incomes will start to feel better and hopefully spending continues. Will this mean a decline in demand for homes? A rise in homes for sale? Not likely. It’s most likely to mean some increase in demand and hopefully some trading of homes–people moving out of and into a new home but a one to one exchange of households.

The results of this shortage of homes to sell is resulting in rapid home appreciation. We’re seeing home values rise 10%+ in the last couple of months in much of the area and 30%+ in much of the region over the last year. So what stops this price appreciation? Nothing in our current or near-term economic forecasts. While it’s easy to ask: “How many people can afford a $1M+ home?” the answer is more than you think. With our record low interest rates a $1M home with a 20% down payment equates to about a $3,266 principal and interest payment. With taxes and insurance this moves up to $4,182. Compare this to recent times when a $500K home with 10% down and a 5% interest rate meant a payment of $3,031. The gap isn’t that big between these two. When you also consider that an average 3 bedroom home rents for around $3,000 and the price tag on a $1M home doesn’t seem so out of line.

When you consider that the owner of a home they bought for $500K, 5 or less years ago can now sell that home for $800K+ and the equity they then have to put down on the $1M home makes that home even more affordable. The point being with so much equity in our current homes and wage levels for those less affected by Covid where they are, a huge percentage of our population can now afford a $1M+ home. Homes priced from $1M to $1.5M have become the most sought after homes in our region, as they are considered the most affordable and desirable homes for a large percent of local buyers.

The perspective of the most informed buyers in our marketplace is not one that focuses on the price of the home but on the monthly payment of the home. They don’t worry about the home’s price because it’s most likely they will never be paying it “off” but instead they consider if they can afford the payments. With current wages and stable employment this perspective and focus is why so many people see today’s market as an opportunity that can’t be passed on in hopes or fears of some dramatic crash in home values. Given our current inventory levels, any bubble burst or calamity likely only creates a very short term relief on price appreciation.

What can we do with this information?

It depends on what is going on in your life; what changes are occurring or anticipated in the next few years. If buying a home is your focus, then teaming up with a well-informed agent and diligent attention to the market is necessary to capture this opportunity. With all the refinances that have taken place it’s likely inventory won’t change that dramatically in your favor. If making a move from your present home to a new one is your focus, the current value of your home combined with record low interest rates means the bridge between your present home and your next home is likely closer now than in the future as your present equity is at a high and it’s likely that economic recovery will put some upward pressure on interest rates, making that new home’s payment higher, regardless of how that compares to your present payment.

If you are thinking “when is the best time to ‘cash out’ take my money and run”—well, typically only the rearview mirror can tell us this but here’s a few points to consider. First, just as we don’t have “a” real estate market, we have many micro markets, there are also many micro peaks. Your home’s size, features, condition and location will adjust where your peak may be. We still have 20-30,000 more new jobs scheduled to come to our region over the next couple of years. This is besides any rebound of jobs in travel, hospitality and dining. That likely means more new people to our area. Yes, many can work remotely but most will stay in our region. A quick side note to this point—King county’s population shifts have gone mostly to other central Puget Sound regional counties–Pierce, Snohomish, Kitsap counties; some to Clark county near Portland but most of the population shifts are still in our local market. So with increasing jobs, increasing populations and a tight inventory, what happens to your home’s value? Likely the peak continues to form. The point being, if you’re ready to “cash it out”, make that call and change when you’re ready is most likely the best advice. Historically we see the most appreciation in our market in the earlier months of a year but as we all learned last year, tomorrow is always uncertain so finding that peak may be more difficult to do than enjoying the timing that fits your life’s goals.

So, how crazy is it out there?

You’d be crazy to not seek guidance from an active, informed agent to help you capitalize on the opportunities and navigate these challenges. Give me a call. I’m happy to help you.

Photo by Edi Libedinsky on Unsplash

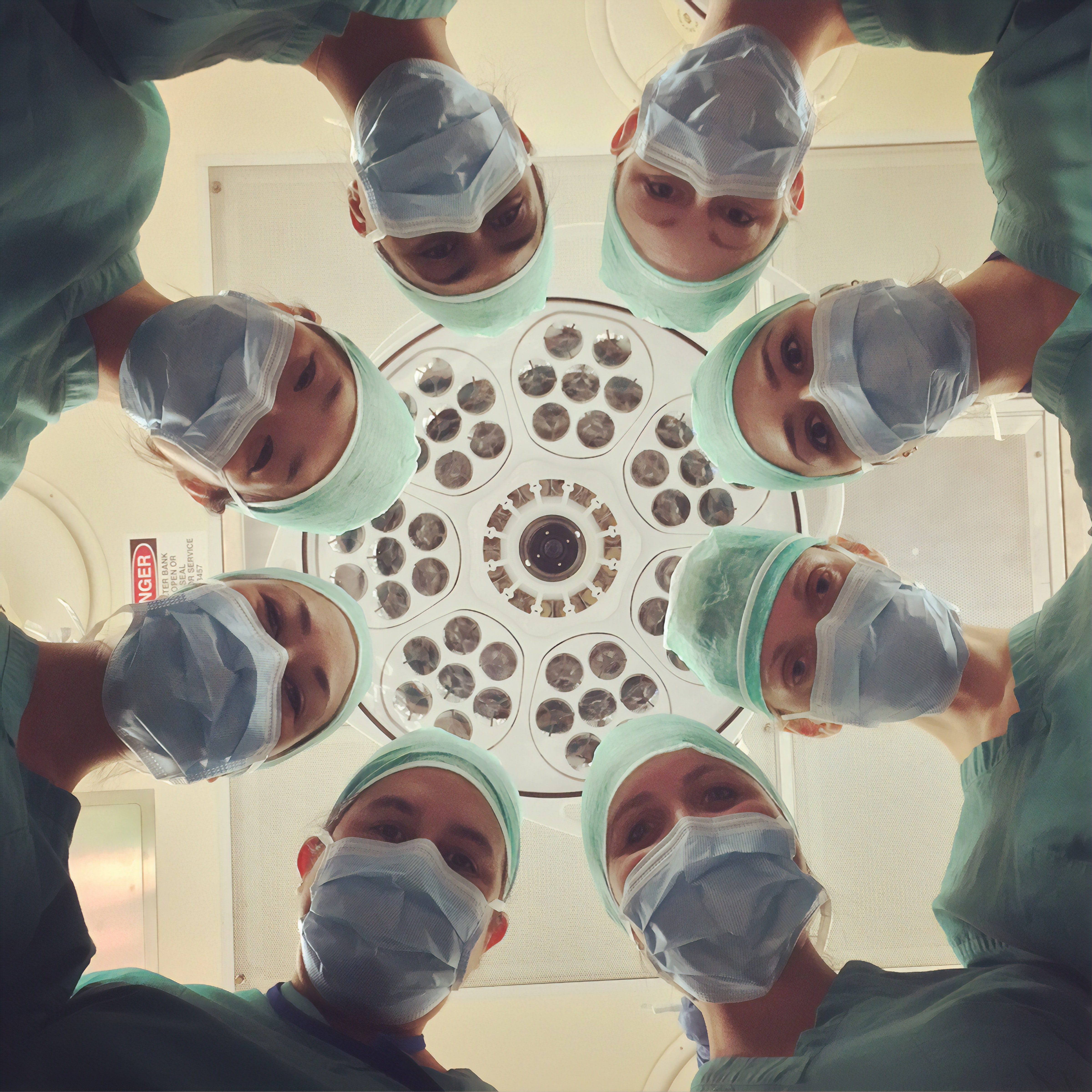

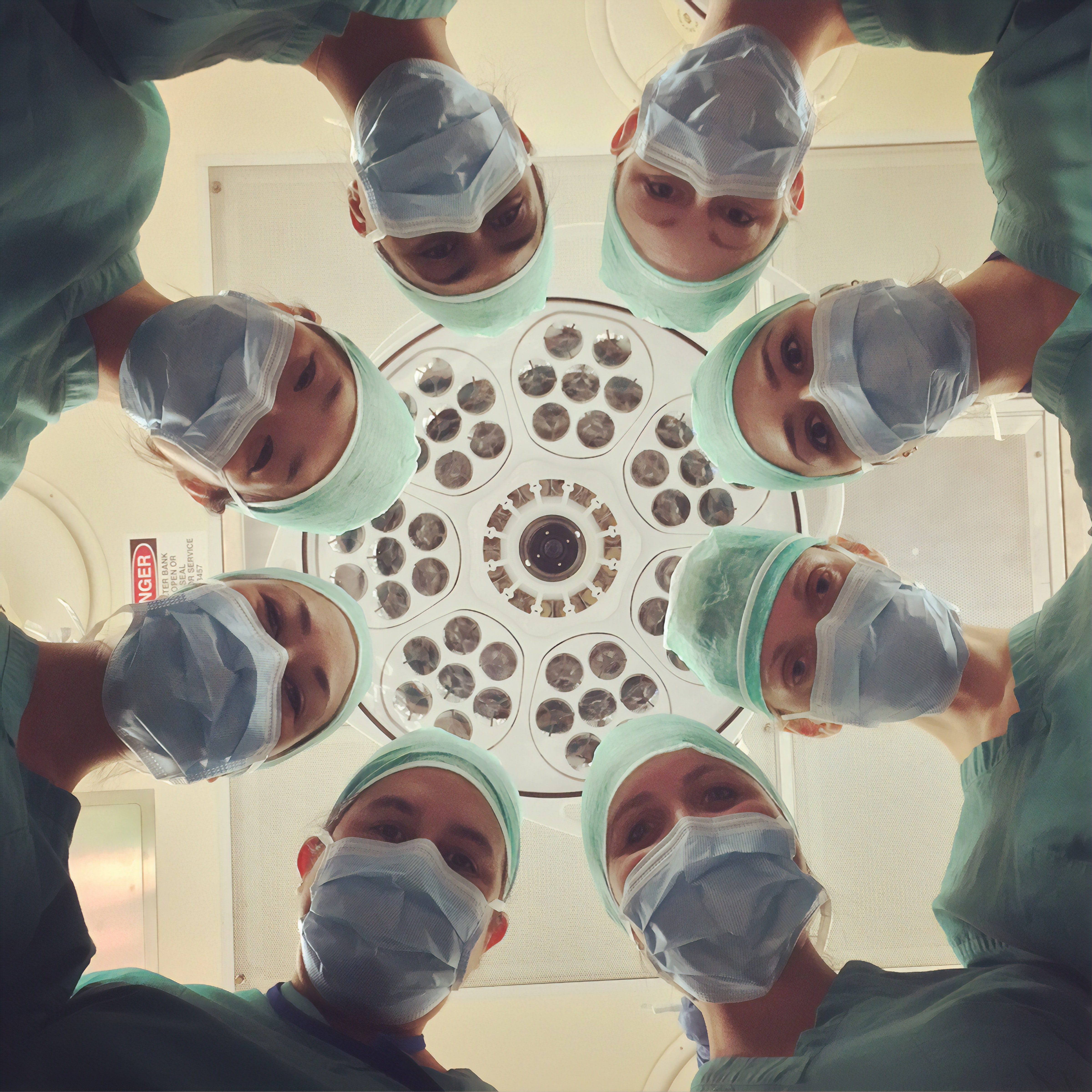

Covid-19 and Real Estate?

There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

We’ve been dealing with this virus for over a month now and we just had an amazingly strong February real estate market. Prices were up, sales were up–even in the face of drastically lower supply of homes which meant quicker sales and multiple offers for Buyers to compete against and Sellers to rejoice in. On the Eastside, 51% of homes sold at or above their asking price, up from 37% in January and 32% a year ago. The percentage over asking price was 34%, compared to 20% a year ago. That’s up 70% compared to last year’s over-asking price percentage. Single family home prices are up 9% over last year and condo sale prices are up 7%.

In Seattle prices remained flat while supply of homes for sale dropped almost 50%. The percentage of over-asking price sales and full price offers went up, almost identically to the Eastside figures. The same percentages and changes occurred for condos in Seattle as on the Eastside. A very strong market by all measures and the same strength is evident from Skagit to Pierce County as well as on the west side of the Sound. Our region is humming along very well.

Photo by National Cancer Institute on Unsplash

With the announcement of Covid-19 in our local region, some are fearing a significant pullback in sales enthusiasm but that’s not translated to reality yet. Open house traffic has been pretty steady over the last couple of weeks. Only time will tell if a pull back will occur but so far demand is winning the tug of war. Typically supply begins to match buyer demand as homes for sale normally spring up like daffodils and tulips as our spring bloom begins. I see no reason to doubt this cycle.

Interest rates have declined to record low levels and this has balanced out the move up in home prices. If the stock market continues to struggle, we’ll likely see more investor flight to safety and security and that often means Mortgage backed securities–especially since the last major recession and the improvement to the quality of these securities. This demand for security by investors should keep our interest rates low and a lid on upward pressures.

The overall strength of our economy and businesses is unquestioned. The Covid fears and transmission of that into the world and local economies is near-term troubling; possibly longer term for some industries like the airlines, cruise ship travel and the travel sector as a whole, but most predictions are for a bottom to be near. Likely we sit still here while we get better data on Covid-19 incidence and health risks/remedies but most indications I’m seeing are still in strong support of American business strength and the American economy as a whole.

Fear may trap too many of us in our homes and cause unnecessary harm to restaurants, entertainment and small businesses. That would be a shame as most people are not sick and need not live shuttered in and in fear. Simple precautions and steps will likely help all of us weather this storm of concern and infection. Treating fear is much harder than a virus and recovering from the unintended consequences can take much longer to complete.

I see no reason to anticipate or expect any significant decline in our sales or prices even if our economies are bombarded by the fear virus on top of Covid-19. The local economy is extremely strong and diversified. Employment and wage growth are active in most career categories. Business expansion is widespread and seems committed to completion regardless of any short term setbacks or surprises. I’d prefer we only deal with Covid-19 but it seems the fear virus is too intertwined.

Negative economic impacts will likely keep our interest rates low for the balance of this year, allowing more affordable payments for homes and a cash resource for those looking to spend some of the equity in their homes. I’m not always a big fan of spending our home’s equity but this is likely the best time to consolidate other debts you may have and likely still lower your monthly mortgage payment as interest rates are very near 3% for 30 year fixed mortgages.

So, what’s the likely effect of Covid-19 on our local housing market? Barring an unusual set of unlikely possibilities, it will hopefully be minimal. Obviously any given family can be upset to devastated by this virus. I hope none of us has the misfortune to suffer this. Let’s all agree that we won’t let fear rule our lives and dictate our activities to an unnecessary degree. Housing is a change and need-driven industry for the most part; we have all the change and need pieces in place to keep our real estate market moving ahead. Stay safe, be wise and we’ll all get through this together.

Buying In A Seller’s Market?

Our winter market has been exceptionally strong since late November. Homes in most price ranges and geographies have sold quickly with very little competition and lots of demand. This is great news for home sellers, so don’t doddle if you’d like to take advantage of these circumstances. For Buyers this isn’t so great. The stock market gyrations drove down interest rates to 5 year lows, as did economic worries and woes around the globe which increased buyer urgency to capture low rates and offered some relief for those “bidding” above and beyond Seller asking prices.

We’ve seen this scenario for the past 4 years now; a bit less so last year but still a strong winter to early spring market bounce. What we also saw the last couple of years were sales prices moderating in the “over asking” price range to more commonly in the 2-3, sometimes 5+% range. This is much better than in 2016 or early 2017 when 20+% was more normal for the winning bid over the asking price. So far this year, it seems to be mostly in this 2-3% range but activity has been very strong and I’ve seen some homes generating 10+% over their asking prices.

While our local market has great optimism and continued pricing pressure for home values, it’s important to recognize that if you are a Buyer have some patience, some time before you have buy and move in and some diligence in your efforts and readiness, you will likely be rewarded by waiting a bit in time. The last few years have seen a pretty dramatic decline in the percentage of “over asking price” offers and what some might think are overly inflated prices. This market shift has been occurring between mid-April and Mother’s Day weekend the last few years, so by very early May. That’s not great relief if you must buy/move now, but it can help you monitor the market for current data points on home values and then be better prepared when more homes come on the market later this spring.

We may see some rise in interest rates from the low levels we presently have, but most expectations are for interest rates to rise from the 3.375 range, back to our more normal level of last fall where 3.5-3.625 were the steady norm. Even if they climb to 3.75%, we’re still in very favorable ranges for borrowing. Don’t let fear drive your decisions. You may also want to consider learning about other possible neighborhoods or areas that might fit your life, school, commute needs, etc. and which might provide some variance to the price points and choices you’re seeing.

One final point for consideration; find an experienced, committed agent who will listen to you. You need experienced and calm help to guide your searches, prospects and offer processes. When the markets get heated, Sellers and their agents want to dictate and control as much of the process as they can. That’s a reasonable expectation. You need to have a known and respected agent, lender and support team to guide you in how to “show up” on an offer and in offer negotiations, so your offer is the best that it can be. There are a myriad of details and nuances that can improve your offer, besides just price. Believe it or not, price doesn’t always win. Sellers care about certainty in the buyers’ offers and that’s something you, as the Buyer, can control. I’m happy to help educate you on what makes the best offers and how to win when your new home shows up. Give me a call or email to meet and talk about your needs and concerns. We can set a strategy or timing plan to make you happy, better informed and ready to act and win.

Photo by Robson Hatsukami Morgan on Unsplash

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link