There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

We’ve been dealing with this virus for over a month now and we just had an amazingly strong February real estate market. Prices were up, sales were up–even in the face of drastically lower supply of homes which meant quicker sales and multiple offers for Buyers to compete against and Sellers to rejoice in. On the Eastside, 51% of homes sold at or above their asking price, up from 37% in January and 32% a year ago. The percentage over asking price was 34%, compared to 20% a year ago. That’s up 70% compared to last year’s over-asking price percentage. Single family home prices are up 9% over last year and condo sale prices are up 7%.

In Seattle prices remained flat while supply of homes for sale dropped almost 50%. The percentage of over-asking price sales and full price offers went up, almost identically to the Eastside figures. The same percentages and changes occurred for condos in Seattle as on the Eastside. A very strong market by all measures and the same strength is evident from Skagit to Pierce County as well as on the west side of the Sound. Our region is humming along very well.

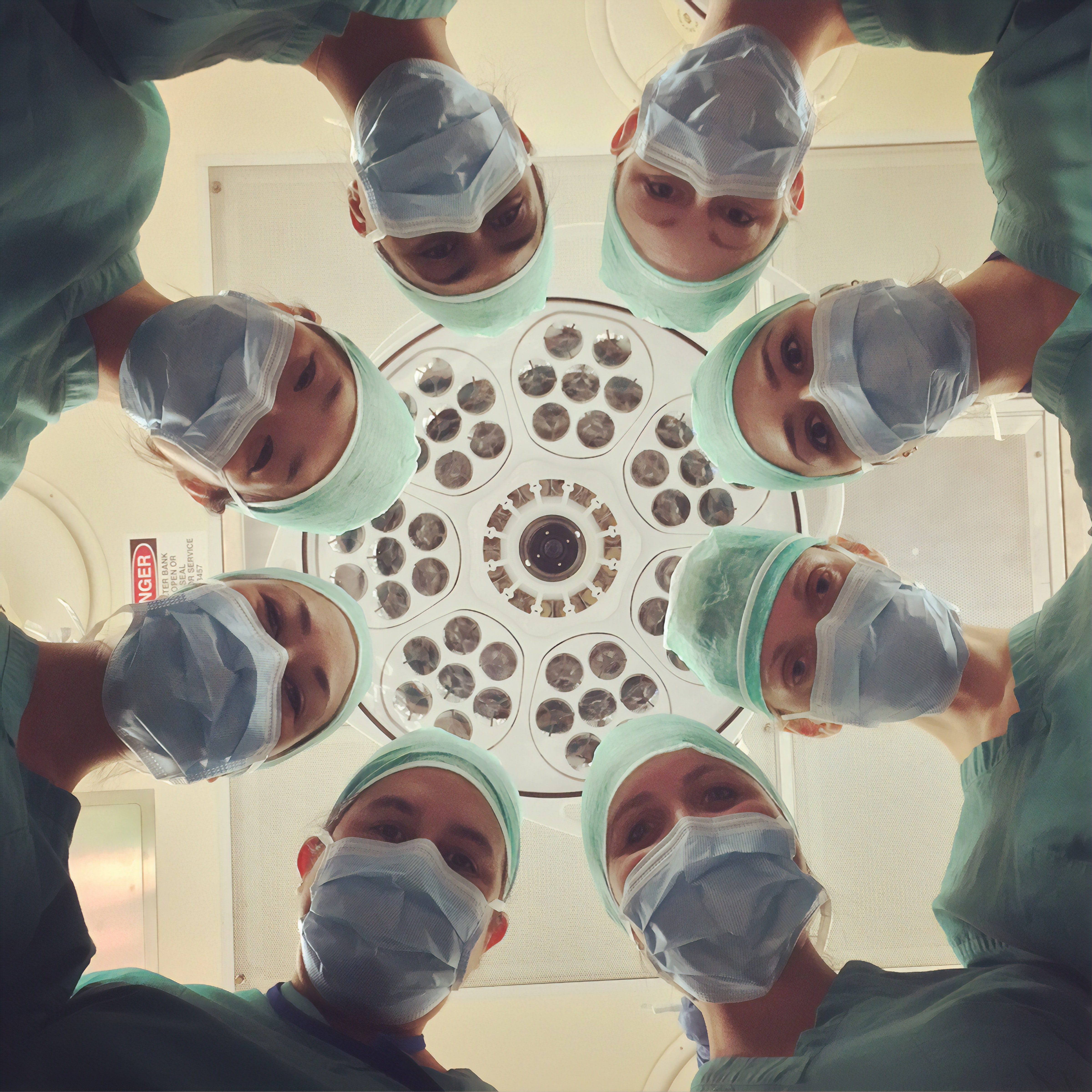

Photo by National Cancer Institute on Unsplash

With the announcement of Covid-19 in our local region, some are fearing a significant pullback in sales enthusiasm but that’s not translated to reality yet. Open house traffic has been pretty steady over the last couple of weeks. Only time will tell if a pull back will occur but so far demand is winning the tug of war. Typically supply begins to match buyer demand as homes for sale normally spring up like daffodils and tulips as our spring bloom begins. I see no reason to doubt this cycle.

Interest rates have declined to record low levels and this has balanced out the move up in home prices. If the stock market continues to struggle, we’ll likely see more investor flight to safety and security and that often means Mortgage backed securities–especially since the last major recession and the improvement to the quality of these securities. This demand for security by investors should keep our interest rates low and a lid on upward pressures.

The overall strength of our economy and businesses is unquestioned. The Covid fears and transmission of that into the world and local economies is near-term troubling; possibly longer term for some industries like the airlines, cruise ship travel and the travel sector as a whole, but most predictions are for a bottom to be near. Likely we sit still here while we get better data on Covid-19 incidence and health risks/remedies but most indications I’m seeing are still in strong support of American business strength and the American economy as a whole.

Fear may trap too many of us in our homes and cause unnecessary harm to restaurants, entertainment and small businesses. That would be a shame as most people are not sick and need not live shuttered in and in fear. Simple precautions and steps will likely help all of us weather this storm of concern and infection. Treating fear is much harder than a virus and recovering from the unintended consequences can take much longer to complete.

I see no reason to anticipate or expect any significant decline in our sales or prices even if our economies are bombarded by the fear virus on top of Covid-19. The local economy is extremely strong and diversified. Employment and wage growth are active in most career categories. Business expansion is widespread and seems committed to completion regardless of any short term setbacks or surprises. I’d prefer we only deal with Covid-19 but it seems the fear virus is too intertwined.

Negative economic impacts will likely keep our interest rates low for the balance of this year, allowing more affordable payments for homes and a cash resource for those looking to spend some of the equity in their homes. I’m not always a big fan of spending our home’s equity but this is likely the best time to consolidate other debts you may have and likely still lower your monthly mortgage payment as interest rates are very near 3% for 30 year fixed mortgages.

So, what’s the likely effect of Covid-19 on our local housing market? Barring an unusual set of unlikely possibilities, it will hopefully be minimal. Obviously any given family can be upset to devastated by this virus. I hope none of us has the misfortune to suffer this. Let’s all agree that we won’t let fear rule our lives and dictate our activities to an unnecessary degree. Housing is a change and need-driven industry for the most part; we have all the change and need pieces in place to keep our real estate market moving ahead. Stay safe, be wise and we’ll all get through this together.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link