Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Confusion Is The State of The Market

We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

So, if not last year at this time, then when or what do we compare to? First, I think you have to recognize that 2021 and early 2022 were such abnormal times in our market that they don’t make a great basis for comparison to start with. When a market is accelerating at such a strong rate, any slow down is going to look extreme. When our weekly or monthly inventory levels were so low, comparing available homes to those times makes any “normal” inventory level look out of balance, especially if you use percentages for comparison. I think a better perspective is to look at the general market sense. We have seen price appreciation settle back down to a 4.5% range for annual appreciation over the past 2 years in Seattle and about 7% per year on the Eastside. By any historical standard, this is a very good rate for homeowners and provides sound reasons for home buyers to want to own their home.

We saw interest rates rise from 3% to 7% between March to September. This again was unprecedented. We’re now seeing rates moderate and drop to the 6.125% range, lower if you’re borrowing in the $1M+ range, closer to 5.5%. Rates are likely to see some bumps and gyrations this spring but the expected trend is for modest declines. There are also some reduced fees for some first time borrowers, to help ease the funds needed to secure a loan. The moderations in rates, even though still well above last winter’s rates, is good for home buyers and sellers. Payments and affordability are improving.

My perspective is this: there is always a market. People want to own their own home–it’s a wise investment and a great stabilizing force in controlling our lives. If you have fears of a recession, you have control over your housing costs, likely lower than rental rates. If you have fears of inflation, you again have control over your housing costs and an appreciating asset. If you have the desire to buy or change your home, the market is looking for good homes and there are solutions to help you afford your new home.

Home buyers are not overwhelmed with home choices in almost any area or price range. The headlines of a glut of inventory are nowhere near accurate. Yes, there’s some inventory, but most of us active in the market know we still have a scarcity of good homes to choose from. This is great news for home sellers. We currently have a stalemate in the thinking of some buyers and sellers in the market. The Sellers want last spring’s prices and the Buyers feel that if they hold out on making offers, home sellers will have to lower their prices. Both parties have too biased of perspectives.

Last spring, buyers were paying 20-40+% over asking prices. As I stated before, we’ve seen those sale prices decline by 15-30% depending on location and price range of the home. Today’s home sellers are generally accepting offers 2-3% under their asking prices. Buyers may be hoping to get 20-40% below asking prices but that’s not realistic and it won’t be going forward, either. Some home sellers still want last year’s values but that too isn’t going to happen. Instead, look at 5-7+% gains of the last few years and accept that’s very strong for annual real estate appreciation. Since most home sellers have owned their homes for 5+ years, your effective gain in value is still phenomenal. Recognize that buyers are still paying a higher price, in terms of monthly payments, than they were last year, so accept your good fortune for the value of your home and sell it, if that is your need, desire or intention.

Many people are fearing a recession this year and we’re now hearing more local employers will be laying off employees versus the hiring freezes we saw last year. Some may feel like they shouldn’t be risking a home purchase during these uncertain times. That’s a very wise consideration. It is never wise to buy a home if you think you will need to sell it in less than 3-5 years. Patience, not fear, can be your friend. I would still offer some perspective to also consider. We’re at near record low unemployment levels. If you were to lose your current job, how likely is it you would find another one, locally, in the near future? For most of our local employees, the answer is usually very good odds for finding a comparably paying job in a fairly short time frame. Still, no one wants to lose their job, without their control. The solution may well be to sit still and ride out the first half of this year and see how your job and company are performing. Interest rates are expected to soften going into the second half of the year and inventory will likely increase to offer you more good choices. Late summer and fall often present better market conditions for home buyers.

While we’re talking about inventory increases, let’s address another unrealistic hope or fear. Home inventories will continue to balloon, foreclosures will rise, home prices will drop substantially and you’ll be able to get that 20% low offer accepted by any or every home seller. Do you recall me talking about the above normal appreciation our local homeowners have been experiencing? This now equates to the average local homeowner having 40+% equity in their home. If they were in real need of their home’s equity, they would sell it, even at today’s prices or lower—if we follow the pessimist’s logic, but certainly not lose it to foreclosure. Additionally, we had 70+% of homeowners, with a mortgage, refinance their home between 2020 and the early spring of 2022. These folks aren’t likely planning to sell their home any time soon. They have as low of a house payment as they can get–lower in most cases than they could rent any type of home for–so they won’t be selling now or in the near future. This will keep overall inventory levels in check. The rationale that panicked home sellers will be flooding the market with inventory isn’t a reality; certainly not in our local market. Pessimistic buyers in this market are looking for “a deal” more than a home. If that’s your perspective, you likely won’t find the deal you want and you’ll miss good opportunities to own a home and asset that will perform very well for you. But they, hopefully not you, were only looking for a deal.

The reality is simple and usually constant for real estate. There is always a market. If you have a need or desire to buy or sell, opportunities are and will be available in this market. We have a more balanced market–supply of homes matching demand by buyers–than we’ve had in the past 4-5 years. We have an overall strong local economy with good, stable employment–even with the headline fears–and we have improving interest rates. We still have increasing household formations as our millennial population grows and a pretty steady supply of the baby boomer population retiring and likely ready to capture their equity and change their housing situation. It’s not frenetic, like the last 2 years, but it’s a market that works for buyers and sellers, if you’re realistic and want to be in the market.

Give me a call to discuss your interests, needs and concerns. We can create a strategy to help you win in these confusing times. I’m happy to talk when you are. Thank you for your time.

Post Photos by Uday Mittal on Unsplash and Brett Jordan on Unsplash

Forbearance Impact on Lending and Home Values

As part of the Corona Virus response from the Federal Government, the Feds have provided an option for homeowners to not make their mortgage payments, with no need to prove a hardship or inability to pay.This is called Forbearance.

There are many moving parts to the mortgage industry, most of which homeowners aren’t aware. I can’t cover all of the behind the scenes details in one post or video, but I wanted to send out this video and basic outline of the potential harm this option can cause.

The bottom line is, if you can make your mortgage payments, please do so. If too many of us don’t, our future lending world and options to borrow for a home loan will get diminished and our home values will decline. Buyers won’t have the ability to meet new lender requirements. Fewer buyers, in any segment of the housing market, impacts all of the housing market–in a negative way.

Let’s limit the impact of the Corona Virus to our health and general economy, not spread it into our housing market. I have lenders able to help you or someone you care about to get financing but we don’t want to lose our options by people unnecessarily avoiding their mortgage payments. I hope you enjoy the video; Live from the Tiki Lounge.

Covid-19 and Real Estate?

There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

There’s no doubt, there’s a lot of fear in our local marketplace. Today we saw our stock indexes drop by 7% and even the good news of great jobs reports from last week, major drops in the costs of oil and record low interest rates can’t seem to win the headlines against Covid-19. So what’s ahead for our market? I wish my bald head was a better crystal ball for knowing the answer but here’s some facts that you may want to know.

We’ve been dealing with this virus for over a month now and we just had an amazingly strong February real estate market. Prices were up, sales were up–even in the face of drastically lower supply of homes which meant quicker sales and multiple offers for Buyers to compete against and Sellers to rejoice in. On the Eastside, 51% of homes sold at or above their asking price, up from 37% in January and 32% a year ago. The percentage over asking price was 34%, compared to 20% a year ago. That’s up 70% compared to last year’s over-asking price percentage. Single family home prices are up 9% over last year and condo sale prices are up 7%.

In Seattle prices remained flat while supply of homes for sale dropped almost 50%. The percentage of over-asking price sales and full price offers went up, almost identically to the Eastside figures. The same percentages and changes occurred for condos in Seattle as on the Eastside. A very strong market by all measures and the same strength is evident from Skagit to Pierce County as well as on the west side of the Sound. Our region is humming along very well.

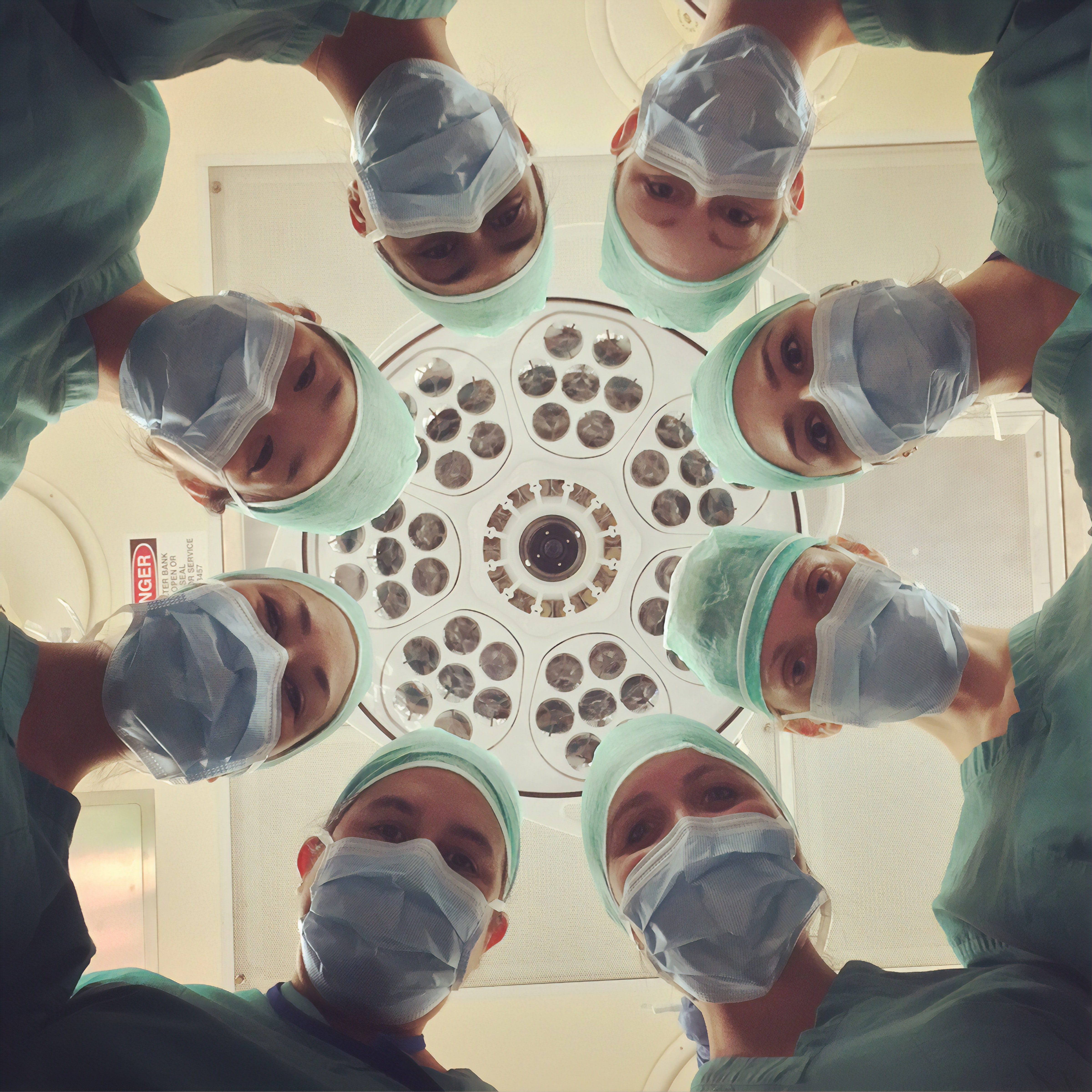

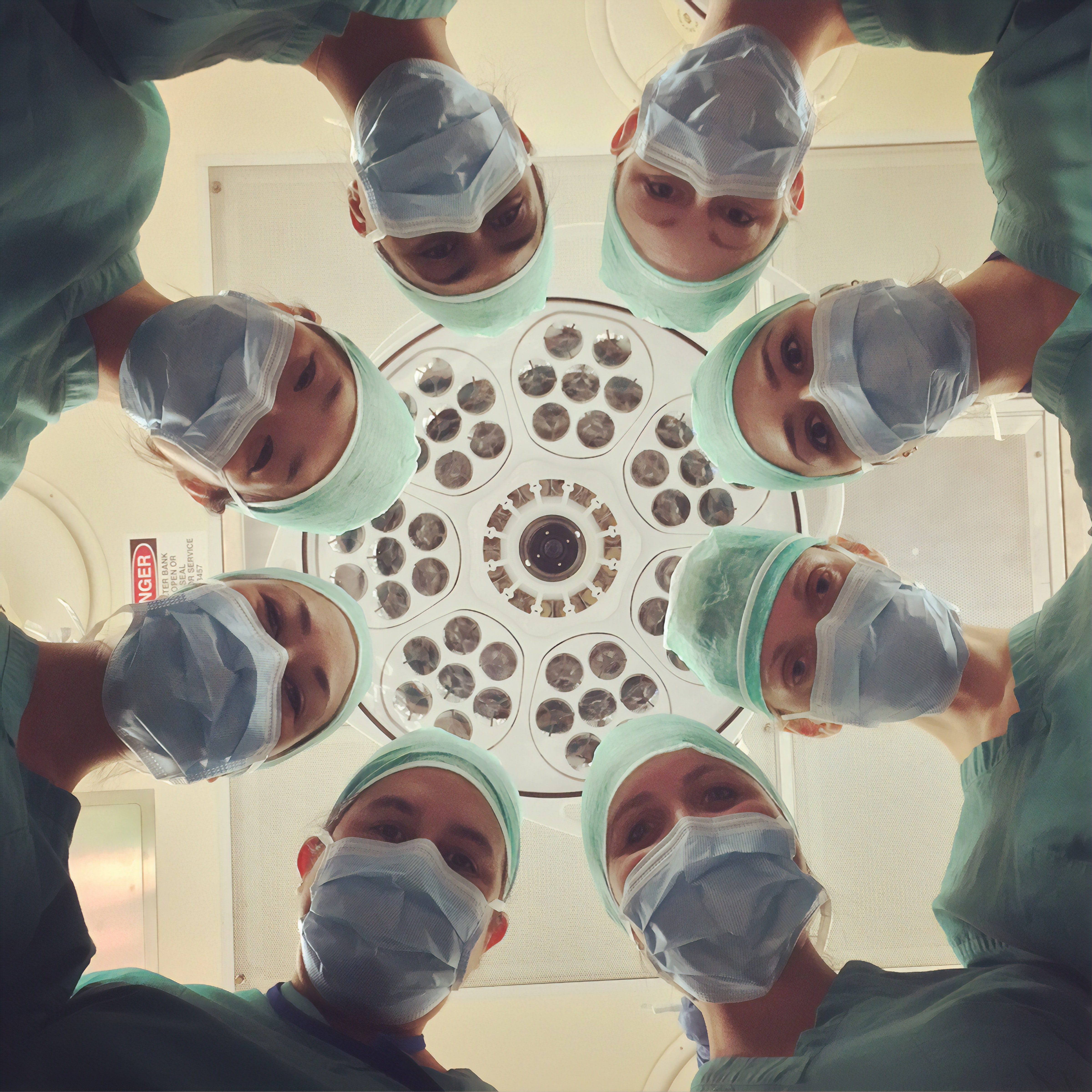

Photo by National Cancer Institute on Unsplash

With the announcement of Covid-19 in our local region, some are fearing a significant pullback in sales enthusiasm but that’s not translated to reality yet. Open house traffic has been pretty steady over the last couple of weeks. Only time will tell if a pull back will occur but so far demand is winning the tug of war. Typically supply begins to match buyer demand as homes for sale normally spring up like daffodils and tulips as our spring bloom begins. I see no reason to doubt this cycle.

Interest rates have declined to record low levels and this has balanced out the move up in home prices. If the stock market continues to struggle, we’ll likely see more investor flight to safety and security and that often means Mortgage backed securities–especially since the last major recession and the improvement to the quality of these securities. This demand for security by investors should keep our interest rates low and a lid on upward pressures.

The overall strength of our economy and businesses is unquestioned. The Covid fears and transmission of that into the world and local economies is near-term troubling; possibly longer term for some industries like the airlines, cruise ship travel and the travel sector as a whole, but most predictions are for a bottom to be near. Likely we sit still here while we get better data on Covid-19 incidence and health risks/remedies but most indications I’m seeing are still in strong support of American business strength and the American economy as a whole.

Fear may trap too many of us in our homes and cause unnecessary harm to restaurants, entertainment and small businesses. That would be a shame as most people are not sick and need not live shuttered in and in fear. Simple precautions and steps will likely help all of us weather this storm of concern and infection. Treating fear is much harder than a virus and recovering from the unintended consequences can take much longer to complete.

I see no reason to anticipate or expect any significant decline in our sales or prices even if our economies are bombarded by the fear virus on top of Covid-19. The local economy is extremely strong and diversified. Employment and wage growth are active in most career categories. Business expansion is widespread and seems committed to completion regardless of any short term setbacks or surprises. I’d prefer we only deal with Covid-19 but it seems the fear virus is too intertwined.

Negative economic impacts will likely keep our interest rates low for the balance of this year, allowing more affordable payments for homes and a cash resource for those looking to spend some of the equity in their homes. I’m not always a big fan of spending our home’s equity but this is likely the best time to consolidate other debts you may have and likely still lower your monthly mortgage payment as interest rates are very near 3% for 30 year fixed mortgages.

So, what’s the likely effect of Covid-19 on our local housing market? Barring an unusual set of unlikely possibilities, it will hopefully be minimal. Obviously any given family can be upset to devastated by this virus. I hope none of us has the misfortune to suffer this. Let’s all agree that we won’t let fear rule our lives and dictate our activities to an unnecessary degree. Housing is a change and need-driven industry for the most part; we have all the change and need pieces in place to keep our real estate market moving ahead. Stay safe, be wise and we’ll all get through this together.

Buying In A Seller’s Market?

Our winter market has been exceptionally strong since late November. Homes in most price ranges and geographies have sold quickly with very little competition and lots of demand. This is great news for home sellers, so don’t doddle if you’d like to take advantage of these circumstances. For Buyers this isn’t so great. The stock market gyrations drove down interest rates to 5 year lows, as did economic worries and woes around the globe which increased buyer urgency to capture low rates and offered some relief for those “bidding” above and beyond Seller asking prices.

We’ve seen this scenario for the past 4 years now; a bit less so last year but still a strong winter to early spring market bounce. What we also saw the last couple of years were sales prices moderating in the “over asking” price range to more commonly in the 2-3, sometimes 5+% range. This is much better than in 2016 or early 2017 when 20+% was more normal for the winning bid over the asking price. So far this year, it seems to be mostly in this 2-3% range but activity has been very strong and I’ve seen some homes generating 10+% over their asking prices.

While our local market has great optimism and continued pricing pressure for home values, it’s important to recognize that if you are a Buyer have some patience, some time before you have buy and move in and some diligence in your efforts and readiness, you will likely be rewarded by waiting a bit in time. The last few years have seen a pretty dramatic decline in the percentage of “over asking price” offers and what some might think are overly inflated prices. This market shift has been occurring between mid-April and Mother’s Day weekend the last few years, so by very early May. That’s not great relief if you must buy/move now, but it can help you monitor the market for current data points on home values and then be better prepared when more homes come on the market later this spring.

We may see some rise in interest rates from the low levels we presently have, but most expectations are for interest rates to rise from the 3.375 range, back to our more normal level of last fall where 3.5-3.625 were the steady norm. Even if they climb to 3.75%, we’re still in very favorable ranges for borrowing. Don’t let fear drive your decisions. You may also want to consider learning about other possible neighborhoods or areas that might fit your life, school, commute needs, etc. and which might provide some variance to the price points and choices you’re seeing.

One final point for consideration; find an experienced, committed agent who will listen to you. You need experienced and calm help to guide your searches, prospects and offer processes. When the markets get heated, Sellers and their agents want to dictate and control as much of the process as they can. That’s a reasonable expectation. You need to have a known and respected agent, lender and support team to guide you in how to “show up” on an offer and in offer negotiations, so your offer is the best that it can be. There are a myriad of details and nuances that can improve your offer, besides just price. Believe it or not, price doesn’t always win. Sellers care about certainty in the buyers’ offers and that’s something you, as the Buyer, can control. I’m happy to help educate you on what makes the best offers and how to win when your new home shows up. Give me a call or email to meet and talk about your needs and concerns. We can set a strategy or timing plan to make you happy, better informed and ready to act and win.

Photo by Robson Hatsukami Morgan on Unsplash

Home Buying Confusion–On the Path to Chaos

In our increasingly global economy, outsiders from everywhere in the world want an “in” to the U.S. real estate market. There seems no end to the amount of money people, companies and investment groups can and will spend to get in to our market. Most claim they “know” how to improve efficiencies, speed up and simplify the processes, save consumers money, aggravation and eliminate the need to talk withe lenders, agents and Realtors. Funny thing is, almost none of these people, investors or companies have any actual real estate industry experience. They speak with supposed authority from a 40,000 foot perspective. None of them recognize a fundamental that every Realtor, agent or loan officer who has survived in this industry for more than 5 years knows–this is a people business, not a commodity or even transaction business. People have personalities, unique needs, circumstances and subjective criteria driving much of their decisions about real estate.

There are Disruptors in every business or industry out there; some better than others with some industries better suited for Disruptors than others. The point being, most of them only want to talk about efficiencies of removing the people, the conversations, the variables and the calculus of weighting all of these market and subjective factors for any one person’s circumstances. Home buyers can look online and get computer generated valuations for most properties, but is that really what they’re worth? According to who and what criteria?

Many think they know what it takes to write a winning offer. They aren’t seeking the advice and counsel of an informed agent in the area they are looking in. They only find out what doesn’t work when their offer is rejected and the home is sold to a different buyer. How can an automated company, unwilling to talk about all of the options you may have available, answer this? It’s not usually just about price. What makes a better offer varies with every property but usually requires a conversation with the buyer, the seller’s agent and the lender involved. Find the common ground and solutions to win and get the home. This takes a willingness to care, to listen, to educate and to be involved. Putting a priority on what’s the most efficient use of the agent’s time shouldn’t be in the matrix of factors for your offer.

New tools and technologies can help make the process more efficient but they can’t replace true conversations, understanding and educating. While Disruptors and Outsiders see buyers and sellers agreeing to sell a home or property, they don’t see the relationships and the time it took to build them, to gain buyer and seller trust with their agents and lenders and to work together to benefit their clients and customers. With all the promise of new widgets and gizmos to make this process simpler, easier and better for the consumer, they don’t

have a way to replace the simple fact that this is a people business. One that requires people talking, educating, understanding, coaching, assisting and counseling Buyers and Sellers on how to find the best opportunities in any market for their actual needs. Speed or simplicity may be “a” factor for some, but when we’re usually talking about people’s long-time homes to buy or sell, speed or simplicity are only a couple of many variables likely considered. Sadly none of the rest will ever be known without an actual conversation with an informed agent or lender to help you.

No one person, group or company will stop Disruptors, but on their present course, the simplification will only lead to more chaos. Information is getting easier to find but knowledge and the ability to apply it are getting more rare. The cost is usually the same for an ill-informed or under-informed person, company or program to help you. Why not get real advice from a quality agent or lender who will truly benefit you, saving you time, frustration and effort as a Buyer or netting you more for your home as a home Seller?

You may know where you want to go but how do you get there?

Photo by Andres Haro on Unsplash

Do Buyer’s Need An Agent?

The answer to this question is often long but for varying reasons. Much is made of fact that buyers can find as much, and in many cases will find out more, about a home than an agent will know. This is a modern day reality for real estate. However having information and knowing how it applies to you are not always the same. Does a buyer need an agent to find a home for sale? Definitely not. Should a buyer utilitize an agent to assist them with the purchase? Most often the answer is definitely so. Why?

No one wants to be bothered by a sales person asking you to act, or trying to insert themselves into your life or "sell" you on a specific property or strategy. We can all agree on this. Where the difficulties arise is in learning and setting expecations for you and helping you learn what you don't know. Knowing how much a seller paid for a home or when they bought it or how much they owe on it, may have no relevance to it's market value, suitability for your needs or how you should structure your offer to buy it. Yet it's all available information. Knowing what the trends are for an area, a neighborhood, a style of home in an area are not so readily available information points that you may need to know to helping you determine a home's value, present day or future and how you should craft your offer.

Many people outside of real estate attempt to make this business a pure science. You learn these facts and based upon them you act in these ways. In reality, much about real estate is an art. People and emotions are involved, as well as money. Pricing homes, crafting winning offers, preparing Buyer profiles and presenting clients to sellers is usually more art than science. While many agents may not be good at this, finding and utilizing ones who are is invaluable to you as a buyer. In our local market, especially with such tight inventory in so much of our area, committing to an agent and being prepared to make changes in your Buyer profile so you can be presented in a stronger light to Sellers and their agents is critical. Having a complete picture of who you are and who's on your team shows that you are prepared to act and you show up differently to Sellers and their agents who will evaluate and make decisions based on this presentation. The highest price offer isn't always the winner. The best offer is usually a combintation of factors. If you want to win without having to outbid all others, you need to know how to draft a better offer and that's science and art blended together by a good agent. Having one on your team, not to annoy you with untimely calls, texts or messaging but providing you real advice and assistance is why you'll often be better served by an agent committed to you. None of us know what we dont' know but a good agent knows how to craft a winning offer and get you the home you want to buy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link