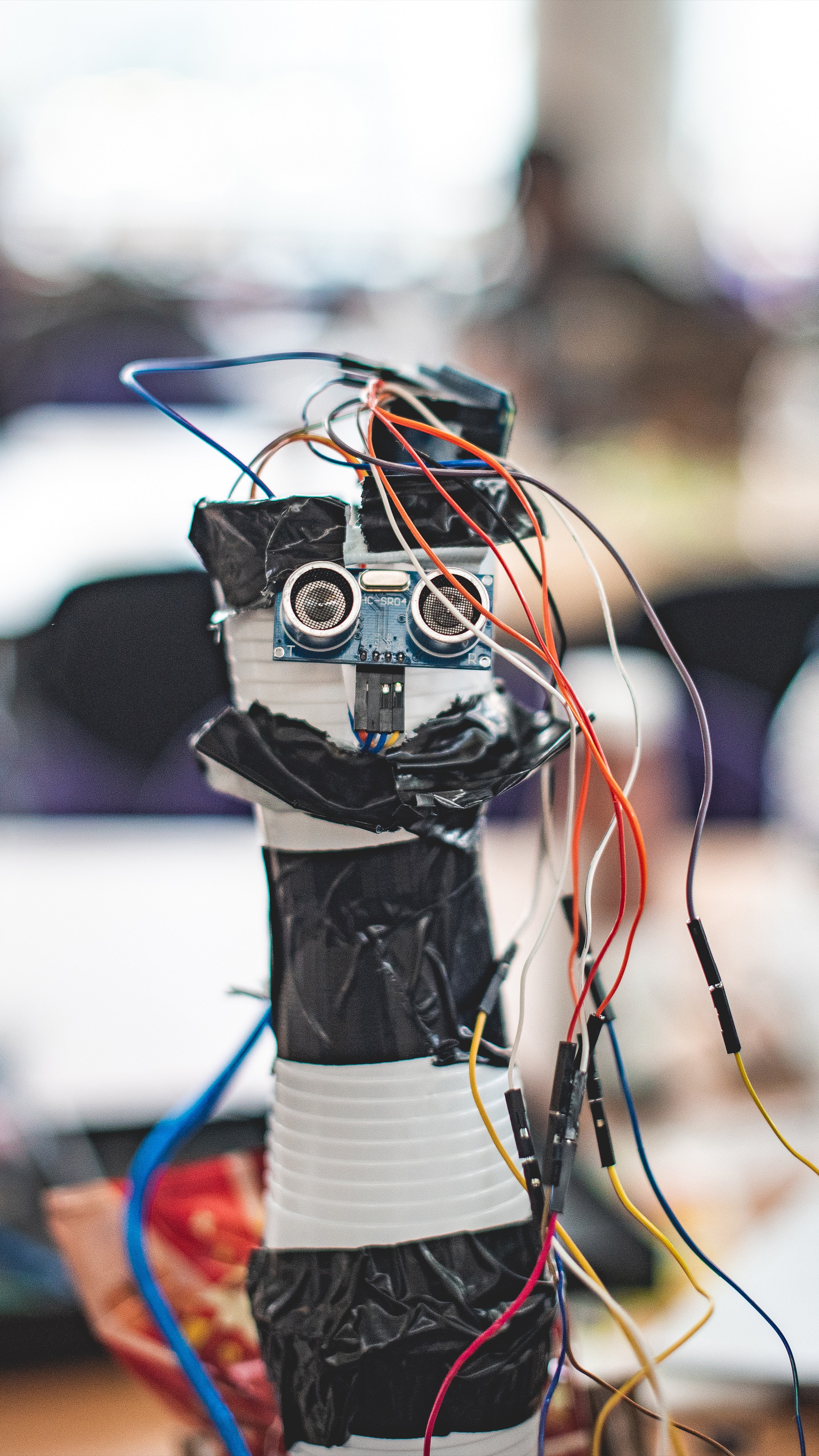

Photo by Valentin Petkov on Unsplash

Technology and outside businesses, mainly backed by financial firms and venture capitalists, are fiercely competing and investing to get deeper into the real estate business. For the past 10 to 15 years these efforts have had minimal success. With their focus now more narrowly set on the amount of money involved in the US residential real estate market, the number of entrants and entrepreneurs involved is growing and some of their efforts are starting to take hold and create opportunities for them and for you as a home owner, seller, buyer or investor. I thought I’d offer some perspective and recap on these latest efforts and coming opportunities. Most of these programs are not yet available in the Seattle market or throughout much of the country, but they likely will be soon, covering most metropolitan markets in the country over the next few years.

A Brief step back in time:

Roughly 20 years ago “Big Data” became a business mantra and the collection, study and mining of this data has created huge businesses. How this relates to you is often by simple, voluntary efforts or moves on your part. You went on Zillow, Redfin or other such sites to see what some algorithm, right or wrong, said your home was worth. You plug in your home’s data, maybe some information about yourself and improvements you’ve made to the home to improve the valuation and this data is then collected, shared, bought, sold and studied; and you get some valuation data point.

Other companies scour public records for data on individual properties, sales records, prices and area turn-over rates. Some real estate Multiple Listing Services also share or shared their data on sales; size of homes, yards, loan amounts, financing types, etc. Combined, this information became a rich data source for companies to “mine” to generate trends, improve their algorithms and valuation tools, so you’d come back again for a new valuation. It also led to a new technology, Predictive Analytics. How soon will you sell your home? This technology was then marketed to agents to “farm” the most likely home sellers in any neighborhood or region of the country. Right or wrong, this is considered a more accurate “target” for agents to buy the data on and make contact with you, the home seller. This system has worked for some agents and companies but not to the degree that most financial-firm backed companies needed to see to get more money from investors to find you and get you connected to them.

These predictive analytics, along with programs like Zillow’s “make me move” helped these companies create larger groups of home owners who were likely to sell, have inquired about their home’s value and stated a price at which they’d sell their home. This refined database, created by Big Data companies, is then used to solicit more capital from investors to create more new real estate companies to meet you.

Enter the I-Buyer

Now the i-Buyer, instant or Internet home buyer arrives. Today, several of these companies and their private investors exist, many run out of companies based in the Seattle area but not offering these services here yet. If you want or need to sell your home, you’ll go on their site and they will tell you in an instant, how much they will pay for your home. No questions, no frills, no hassles; they buy your home.

This convenience may be worthwhile to some home sellers, but, of course, most of us ask, “but at what price?” That varies with the property, the company and the seller. What this isn’t, though, is a negotiation. They don’t offer you a price to which you counter and go back and forth. This is a price, take it or leave it. Most of these companies admit they only buy about 10% of the homes they bid on. However, in the process of this conversation and bidding, they now know you, your property, it’s improvement details, when you want to be sold and moved, etc. A great data collection tool; information you willingly gave them, even though you didn’t end up selling your home to them. They got value from you; you got frustration from them.

Now comes the next step. They have all of your contact and property data and can now refer you to an agent in their company to help you market and sell your home on the open market, or they can now sell your information to any agent willing to pay for it, to farm, prospect or pursue you to sell your home. Big data has gathered and entwined you in their data web, as you provided more data about you, your circumstances and the property, which makes their improved data more valuable. This is a key goal for these new entrants; to be a giant lead generation system for them to use or to sell to anyone and you voluntarily stepped into it by innocently asking what’s my home worth or what would they pay for it.

So What’s the Concern?

This can be seen as sinister; entrapping you and your data; selling it to others to pursue you and your property. These companies see it as a way to control owners, sellers, buyers and property. Under the guise of convenience for you, they’re collecting huge amounts of data or ownership on homes around the country. Several of these companies now own thousands to tens of thousands of homes in various markets. They also now have a database of homes they know people want to sell. This provides them lures to attract buyers by marketing these on or off-market homes to buyers searching on their websites. They don’t need to be listed for sale by an agent, company or in a Multiple Listing Service. The company controls the data. If a buyer is interested in a home, the more valuable that piece of data becomes. Need financing to buy one of their homes? They’ll send you financing quotes with the click of a button and a bit more data from you. Want to “trade” your home for one of these new homes? They’ll offer you an instant buy out for your home and you get to buy the home they own. It’s quick, hassle free and you get to avoid talking with a real estate agent.

Are you more than data? Shouldn’t your goals be the focus? Photo by Mariann Gyorke on Unsplash

Now that they have all this data on you as a buyer, seller or both, they also know what “normal” expenses, steps and services you might also need or want. Home movers, cleaners, craftsmen, painters, plumbers, roofers, landscapers, electricians, security and insurance companies, title and mortgage services, etc. Venture capitalists back these companies that are buying into or outright ownership of these providers and services. They are signing up thousands of service providers to send your way—as long as the service provider pays them a fee to find you.

Amazon just partnered with the largest real estate parent company in the country to provide $500-$5,000 worth of services and products to every home buyer who works with one of these brokerages, depending on the price of home you buy. That’s not a great buyer incentive but it is a small loop to have you step in to gather more data on you. The more of these services and products you buy, the more data is collected on you and your buying habits. The role of the real estate transaction or even your innocent inquiry into “what’s my home worth” has spiraled into an amazing tie-in of data and possible revenue. Real estate has the most tentacles into all businesses in the economy. It’s a central role that large financial firms and big data companies now want to be a bigger part of.

Again, this isn’t meant to be read as sinister or even unusual or unique to the real estate industry. It’s just to enlighten you as to why, how and where the payoff for these new companies is coming from. You are the bait; that part is real and undeniable. These venture-capitalized companies claim to care about you but if their market price offers are so fair, why are only 10% of them accepted? Some of these companies state their Investors aren’t expecting a return on their money, seeking to just revolutionize our antiquated industry! Really? They invest $200-300M with no expectation of a return on their money? Zillow claims to be losing $2-3K per house right now, but expect to make that up by the collection and sale of their data and other services going forward. As a Realtor for 33 years, I’m bothered by this idea of my clients as bait. I am always happy to offer you an honest valuation for your home or property; for free, no big data collection, just honest conversation about your goals and options to help you get there. Can I buy your home today or this week? No, but I can help you find real alternatives that focus on you and your goals. The point being, my focus is on helping you solve your problem; their focus is on your data.

These are big purchase and/or sale decisions and the majority of people still want experienced, competent help, guidance and advice with this process. An Instant Offer may be a solution but just be aware what their real focus is, your data vs. your problem. They’ll make money from your data regardless of the outcome or concern for your goal or needs. If you’d rather the focus be on you, your options and real solutions to your problems, give me a call. There are always nuances in the market and you will benefit from understanding them and how they affect you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link