We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

We have data, headlines, whispers and fears running in all directions at this time. It is beyond me, and from what I’ve read, seen or heard, it seems beyond anyone to say they “know” what the market is or will do. Some of our region has prices still up from last year while other parts of our market are off 3-6% from this time last year. But is comparing to last year really of value? We had peak pricing last April to May that was 15-30% over today’s prices, so does it sound genuine to say our prices are in line, slightly above or slightly below last year? Not likely for most home sellers and home buyers know these statistics aren’t reflecting the actual market conditions or temperament.

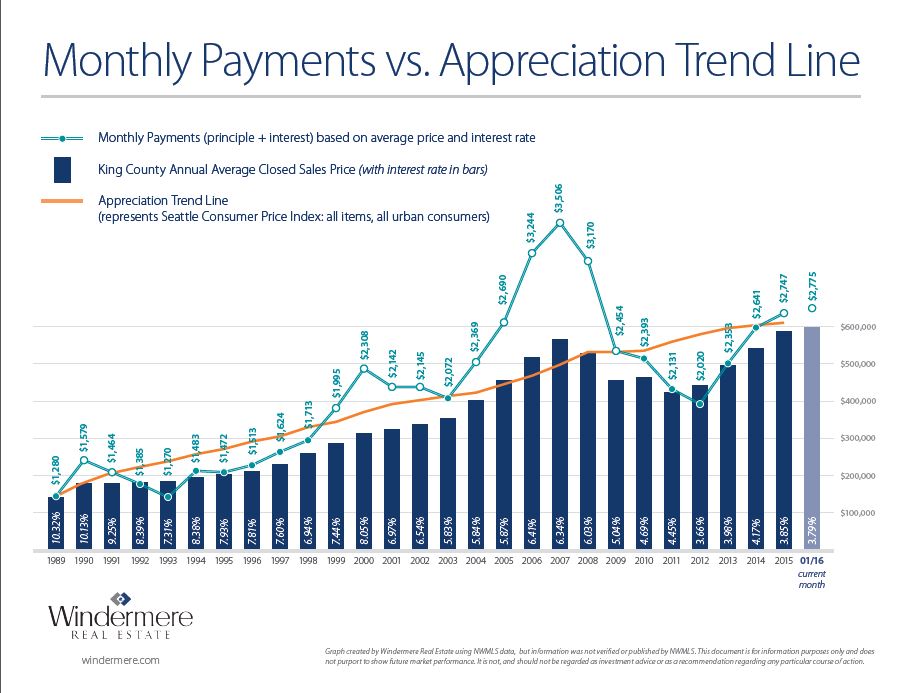

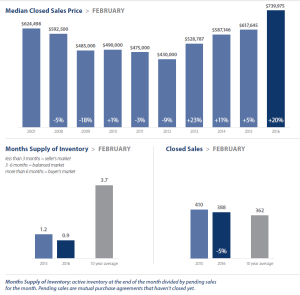

So, if not last year at this time, then when or what do we compare to? First, I think you have to recognize that 2021 and early 2022 were such abnormal times in our market that they don’t make a great basis for comparison to start with. When a market is accelerating at such a strong rate, any slow down is going to look extreme. When our weekly or monthly inventory levels were so low, comparing available homes to those times makes any “normal” inventory level look out of balance, especially if you use percentages for comparison. I think a better perspective is to look at the general market sense. We have seen price appreciation settle back down to a 4.5% range for annual appreciation over the past 2 years in Seattle and about 7% per year on the Eastside. By any historical standard, this is a very good rate for homeowners and provides sound reasons for home buyers to want to own their home.

We saw interest rates rise from 3% to 7% between March to September. This again was unprecedented. We’re now seeing rates moderate and drop to the 6.125% range, lower if you’re borrowing in the $1M+ range, closer to 5.5%. Rates are likely to see some bumps and gyrations this spring but the expected trend is for modest declines. There are also some reduced fees for some first time borrowers, to help ease the funds needed to secure a loan. The moderations in rates, even though still well above last winter’s rates, is good for home buyers and sellers. Payments and affordability are improving.

My perspective is this: there is always a market. People want to own their own home–it’s a wise investment and a great stabilizing force in controlling our lives. If you have fears of a recession, you have control over your housing costs, likely lower than rental rates. If you have fears of inflation, you again have control over your housing costs and an appreciating asset. If you have the desire to buy or change your home, the market is looking for good homes and there are solutions to help you afford your new home.

Home buyers are not overwhelmed with home choices in almost any area or price range. The headlines of a glut of inventory are nowhere near accurate. Yes, there’s some inventory, but most of us active in the market know we still have a scarcity of good homes to choose from. This is great news for home sellers. We currently have a stalemate in the thinking of some buyers and sellers in the market. The Sellers want last spring’s prices and the Buyers feel that if they hold out on making offers, home sellers will have to lower their prices. Both parties have too biased of perspectives.

Last spring, buyers were paying 20-40+% over asking prices. As I stated before, we’ve seen those sale prices decline by 15-30% depending on location and price range of the home. Today’s home sellers are generally accepting offers 2-3% under their asking prices. Buyers may be hoping to get 20-40% below asking prices but that’s not realistic and it won’t be going forward, either. Some home sellers still want last year’s values but that too isn’t going to happen. Instead, look at 5-7+% gains of the last few years and accept that’s very strong for annual real estate appreciation. Since most home sellers have owned their homes for 5+ years, your effective gain in value is still phenomenal. Recognize that buyers are still paying a higher price, in terms of monthly payments, than they were last year, so accept your good fortune for the value of your home and sell it, if that is your need, desire or intention.

Many people are fearing a recession this year and we’re now hearing more local employers will be laying off employees versus the hiring freezes we saw last year. Some may feel like they shouldn’t be risking a home purchase during these uncertain times. That’s a very wise consideration. It is never wise to buy a home if you think you will need to sell it in less than 3-5 years. Patience, not fear, can be your friend. I would still offer some perspective to also consider. We’re at near record low unemployment levels. If you were to lose your current job, how likely is it you would find another one, locally, in the near future? For most of our local employees, the answer is usually very good odds for finding a comparably paying job in a fairly short time frame. Still, no one wants to lose their job, without their control. The solution may well be to sit still and ride out the first half of this year and see how your job and company are performing. Interest rates are expected to soften going into the second half of the year and inventory will likely increase to offer you more good choices. Late summer and fall often present better market conditions for home buyers.

While we’re talking about inventory increases, let’s address another unrealistic hope or fear. Home inventories will continue to balloon, foreclosures will rise, home prices will drop substantially and you’ll be able to get that 20% low offer accepted by any or every home seller. Do you recall me talking about the above normal appreciation our local homeowners have been experiencing? This now equates to the average local homeowner having 40+% equity in their home. If they were in real need of their home’s equity, they would sell it, even at today’s prices or lower—if we follow the pessimist’s logic, but certainly not lose it to foreclosure. Additionally, we had 70+% of homeowners, with a mortgage, refinance their home between 2020 and the early spring of 2022. These folks aren’t likely planning to sell their home any time soon. They have as low of a house payment as they can get–lower in most cases than they could rent any type of home for–so they won’t be selling now or in the near future. This will keep overall inventory levels in check. The rationale that panicked home sellers will be flooding the market with inventory isn’t a reality; certainly not in our local market. Pessimistic buyers in this market are looking for “a deal” more than a home. If that’s your perspective, you likely won’t find the deal you want and you’ll miss good opportunities to own a home and asset that will perform very well for you. But they, hopefully not you, were only looking for a deal.

The reality is simple and usually constant for real estate. There is always a market. If you have a need or desire to buy or sell, opportunities are and will be available in this market. We have a more balanced market–supply of homes matching demand by buyers–than we’ve had in the past 4-5 years. We have an overall strong local economy with good, stable employment–even with the headline fears–and we have improving interest rates. We still have increasing household formations as our millennial population grows and a pretty steady supply of the baby boomer population retiring and likely ready to capture their equity and change their housing situation. It’s not frenetic, like the last 2 years, but it’s a market that works for buyers and sellers, if you’re realistic and want to be in the market.

Give me a call to discuss your interests, needs and concerns. We can create a strategy to help you win in these confusing times. I’m happy to talk when you are. Thank you for your time.

Post Photos by Uday Mittal on Unsplash and Brett Jordan on Unsplash

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link